That oversized house on a sunny Santa Cruz Street — the one with the garden full of memories — isn’t just a home. For many baby boomers’ real estate owners, it’s a nest egg, a lifetime of savings and decisions wrapped into one address. But now, a quirk in tax law is doing something unexpected: it’s locking many long-time Santa Cruz owners into homes they’d rather leave. That lock? capital gains tax Santa Cruz realities and the math that follows a sale.

This post explains how capital gains tax home selling rules are freezing the market in Santa Cruz, what it means for real estate buyers and sellers, the local communities, and practical steps you — whether buyer, seller, or advisor — can use to navigate the next year (and beyond). I’ll ground the numbers, show you the tradeoffs, and answer the questions buyers and sellers in Santa Cruz ask most.

Inside this Article:

What Is Capital Gains Tax and Why It’s Freezing Santa Cruz’s Housing Market

You might think the tight housing supply in Santa Cruz comes from zoning limits, coastal preservation rules, or simply the appeal of beachside living. Those are part of the story — but a bigger, quieter factor is tax policy.

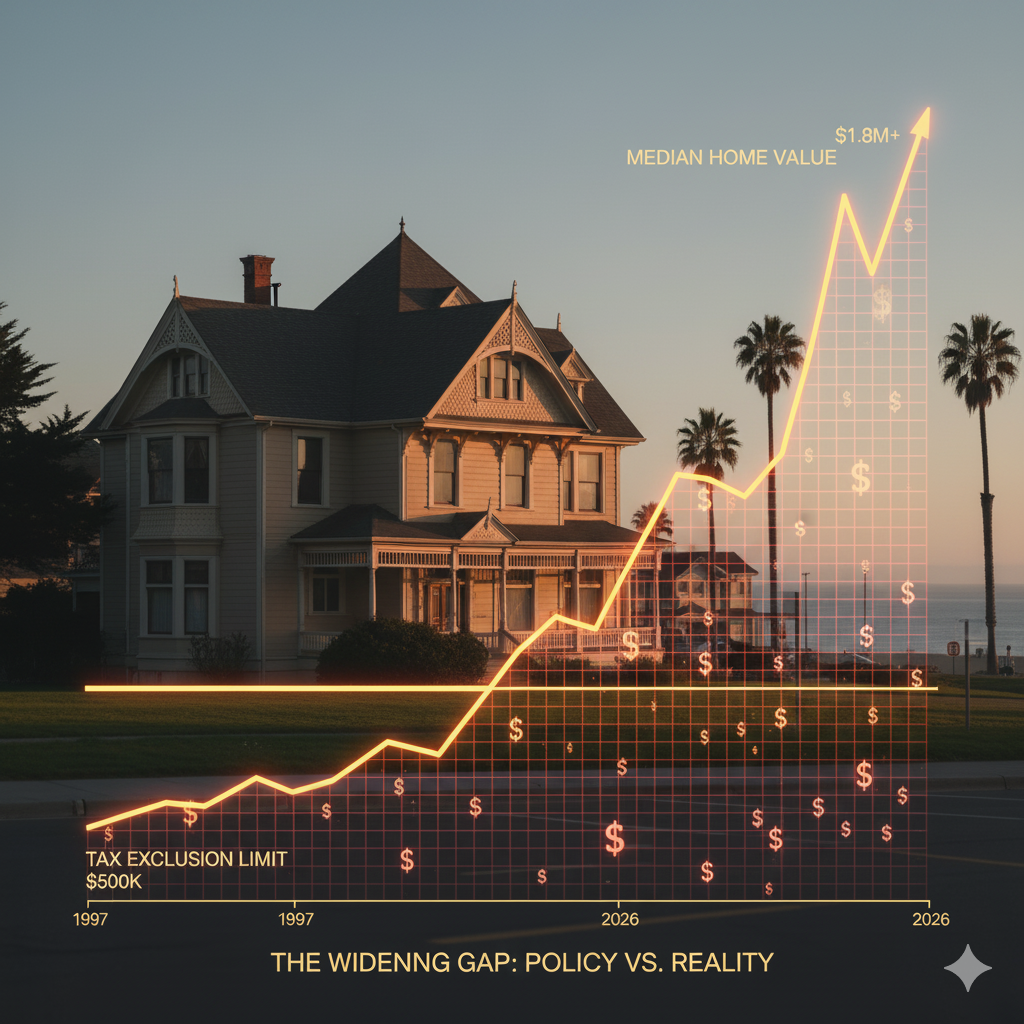

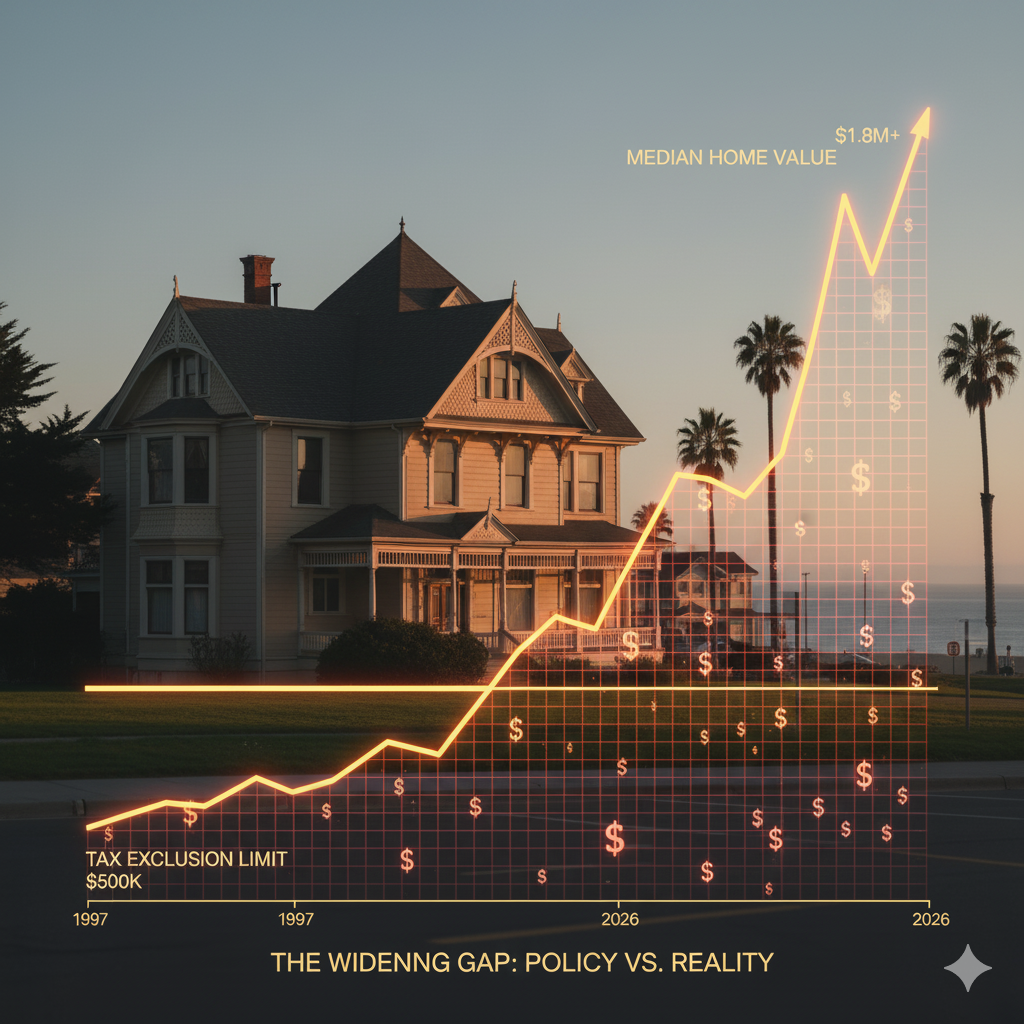

The Taxpayer Relief Act of 1997 (TRA97) established the current capital gains exemptions California homeowners rely on:

- $250,000 for single filers,

- $500,000 for married couples filing jointly.

These exclusions apply when you’ve lived in your home for two of the last five years. Before TRA97, homeowners could roll over profits into a new home or take a one-time $125,000 exclusion at age 55. Congress replaced that system with fixed caps — high at the time, but untouched since 1997.

However, according to Moody’s Analytics, nearly three decades of appreciation have made those caps woefully inadequate. If the exclusions had been indexed to consumer inflation, they’d be $500,000/$1,000,000 today. If indexed to home price growth, they’d be $885,000/$1,775,000 — almost triple.

This widening gap between policy and reality is at the heart of the capital gains tax impact home sellers now face in Santa Cruz.

Understanding Capital Gains: The Basics

When you sell your home (or any assent) for more than you paid, the difference is your capital gain — and that’s what gets taxed.

- Short-term capital gains apply if you owned the property for one year or less. These are taxed like your regular income.

- Long-term capital gains apply after one year and are taxed at lower, preferential rates — typically between 15% and 20% federally.

Here’s the reality check for Santa Cruz homeowners. When your home has appreciated by a million dollars or more, even these so-called "lower" tax rates translate into a life-changing, six-figure bill.

And in California, the math gets even tougher. The California Chamber of Commerce confirms the state's top income tax rate is now 14.4% — rose from 13.3% to 14.4% as of January 1, 2024. When you combine that with federal rates and the 3.8% Net Investment Income Tax (NIIT), sellers can easily lose 35–38% of their taxable gain to taxes.

This isn't just a number on a page. It's the defining capital gains tax home selling challenge that forces many families to make an impossible choice: take a massive financial loss or stay put in a home that no longer fits their life.

The $500,000 Rule That Time Outgrew

When the IRS set the $250,000/$500,000 exclusion in 1997, it was meant to simplify recordkeeping and protect most homeowners. But in high-growth regions like Santa Cruz, it hasn’t kept pace.

If indexed to inflation, the caps would now be $500,000/$1,000,000. If indexed to home price growth (as Moody’s estimates), they’d be $885,000/$1,775,000. That’s a massive difference — and it shows why the exclusion, while generous 30 years ago, no longer shields the typical Santa Cruz seller.

It’s not just a financial hit — it’s the reason many homes never reach the market.

Consider these hypothetical scenarios:

Case A — The Long-Timer Couple (Capitola)

A couple in Capitola bought their home back in 1989 for $180,000. That same home is now worth close to $1.9 million.

After using their $500,000 married couple exclusion, they're still looking at a taxable gain of over $1.2 million. The math doesn't lie—that could mean a combined tax bill pushing $400,000.

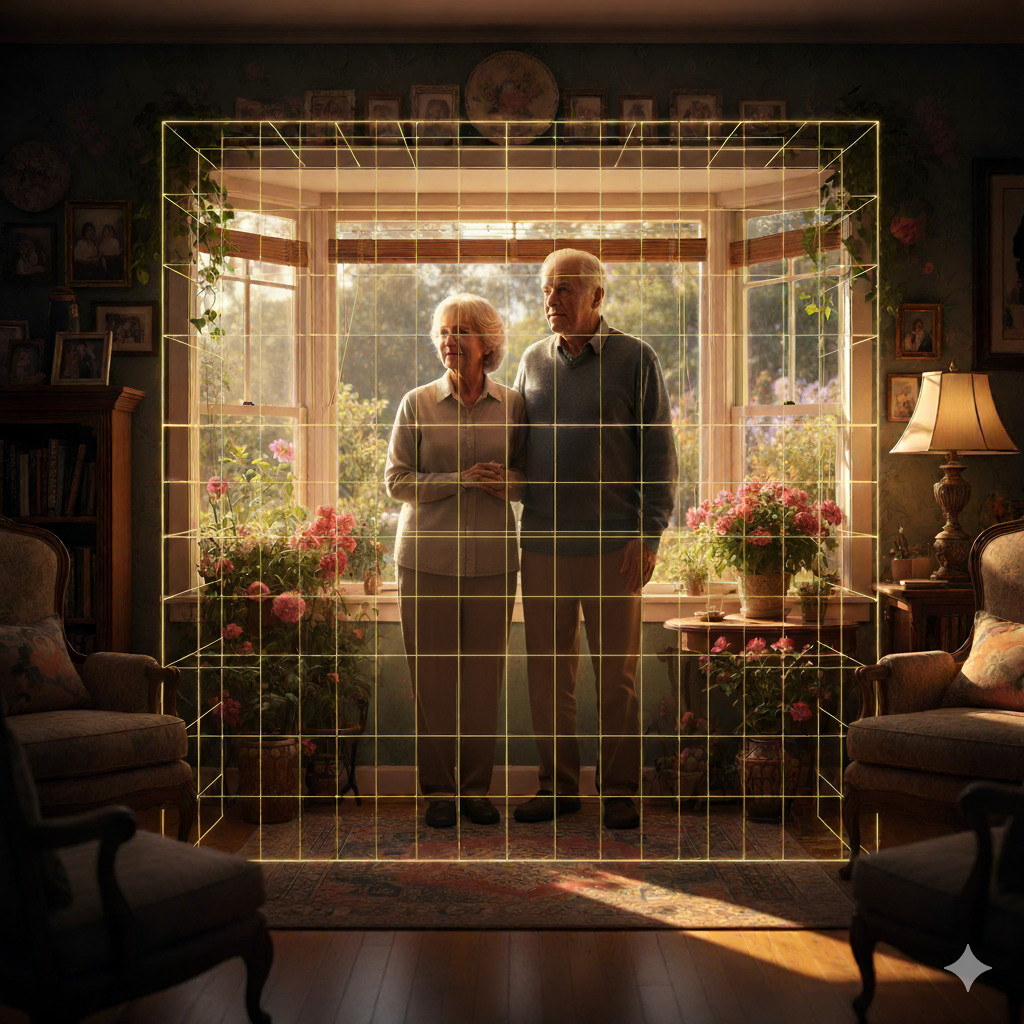

Suddenly, the dream of downsizing to a manageable Aptos condo doesn't pencil out. That tax bill would wipe out the equity they need for a comfortable retirement. So, what do they do? They stay put. And their family-sized home stays off the market for a young family that needs it.

Case B — The Widow in Soquel

Consider a widow in Soquel who recently inherited her family’s longtime home. She dreams of moving closer to her children, but there’s a major roadblock: because the property doesn’t meet the Primary Residence Rule, she isn’t eligible for the $500,000 exclusion.

If she sells now, the capital gains tax on that sale would consume a significant portion of her retirement savings — money she needs for security and independence. Faced with that kind of loss, she makes the only practical choice: she waits. Like many others across Santa Cruz County, she’s hoping for a policy update or relying on the potential step-up in basis her heirs could receive later on.

These stories are a perfect example of the boomers selling home tax implications we see every day—a financial trap that's personally painful for them and directly freezing supply across Santa Cruz County.

How Capital Gains Taxes Shape the Santa Cruz Housing Market

This tax dilemma isn’t just a line on a spreadsheet — it’s shaping how we live here in Santa Cruz. Here’s what it really means for you and your neighbors:

- Vanishing Inventory. To avoid massive tax bills, many longtime owners simply hold on to their homes. That means fewer family-sized properties ever make it to market — tightening the supply and keeping would-be sellers stuck.

- Sky-High Prices. With so few listings available, real estate buyers 2026 are competing fiercely for every home that hits the market. The result? Prices climb even higher, stretching affordability further out of reach across the Santa Cruz real estate 2026 landscape.

- Frozen Mobility. Retirees remain in homes that no longer fit their needs, while younger families struggle to find their first foothold. This is the true ripple effect — the lasting impact of capital gains tax on the Santa Cruz housing market that keeps our community gridlocked.

Economists call this the “lock-in effect.” For Santa Cruz, it’s visible in every neighborhood — from Seabright to Aptos. As a result, Santa Cruz property market trends have occasionally shown unusually low turnover rates compared to other California metros.

Summary of CITY OF Santa Cruz Housing and Climate Tax Measures from Recent Election

The provided text discusses two ballot measures from the City of Santa Cruz aimed at generating funds for affordable housing and climate resilience.

Measure C: Workforce Housing Affordability Act of 2025

- Goal: To fund affordable housing for local workers, seniors, veterans, persons with disabilities, and to reduce/prevent homelessness.

- Funding Mechanism:

- Parcel Tax: $96 annual tax.

- Real Estate Transfer Tax: Graduated tax on home sales above $1.8 million, capped at $200,000 per transaction.

- Estimated Revenue: Aims to raise $4.5 million annually.

- Outcome: The measure Passed.

Measure B: Workforce Housing and Climate Protection Act of 2025

- Goal: Similar to Measure C, but also included increasing climate resilience. Funds were for affordable housing for local workers, seniors, veterans, persons with disabilities, and to reduce/prevent homelessness.

- Funding Mechanism:

- Parcel Tax: A lower tax of $50 annually.

- Real Estate Transfer Tax: A lower transfer tax on home sales above $4 million, capped at $100,000 per transaction.

- Estimated Revenue: Estimated to raise just $1.1 million annually (significantly less than Measure C).

- Outcome: The measure failed.

Both measures sought to address housing and homelessness issues through local taxation.

What is a Parcel Tax?

A parcel tax is a tax levied by a local government (like a city, school district, or special district) on each unit of property, known as a "parcel," within its jurisdiction.

- Flat Fee: The most common form, and the one proposed in the Santa Cruz measures (Measure C was $96, Measure B was $50), is a flat tax—meaning the tax amount is the same for nearly every property owner, regardless of the property's size, value, or use (though some can be based on size or use).

- Not Based on Value: Crucially, unlike the general property tax which is based on a property's assessed value (ad valorem), a parcel tax is not based on value. This structure is often used by California local governments because it is a way to raise local revenue outside of the restrictions set by Proposition 13.

- Purpose: Parcel taxes are often used to fund specific local services or initiatives, like schools, fire protection, or, in the case of the Santa Cruz measures, affordable housing.

- Voter Approval: In California, a parcel tax typically requires a two-thirds (66.7%) majority of voters to pass, though if a measure is placed on the ballot through a citizen initiative (like Measure C was), it may only require a simple majority (50% + 1).

- Exemptions: These measures often include exemptions for certain groups, such as low-income seniors or persons with disabilities, as Measure C did.

What is a Real Estate Transfer Tax?

A real estate transfer tax (also called a documentary transfer tax or conveyance tax) is a one-time tax charged by a state, county, and/or city government when ownership of a property is officially transferred from one party (the seller) to another (the buyer).

- One-Time Fee: It is paid at the time of the sale, usually as part of the closing costs.

- Based on Sale Price: The tax is almost always calculated as a percentage or a set dollar amount per value (e.g., a few dollars per $1,000) of the property's sale price or fair market value.

- Graduated Tax (The Santa Cruz Proposal): The Santa Cruz measures proposed a graduated or tiered transfer tax. This means the tax rate is not a single, flat percentage but increases as the home's sale price goes up, making it primarily a tax on high-value properties:

- Measure C, for example, only applied to home sales above $1.8 million, with the tax rate increasing for higher price tiers.

- Measure B was structured similarly but had a much higher threshold, only applying to sales above $4 million.

- Who Pays: The responsibility for paying the transfer tax is often negotiated between the buyer and seller, but is sometimes legally specified by the local jurisdiction.

In summary, the City of Santa Cruz was attempting to use two different types of local taxes—a small, annual, flat fee (Parcel Tax) and a large, one-time tax on high-end home sales (Transfer Tax)—to create a dedicated revenue stream for their housing and climate goals. These type of local tax measures are sure to be followed by other cities throughout the state.

What It Means for Buyers in 2026

Looking ahead to the Santa Cruz real estate 2026 cycle, buyers should prepare for a market still shaped by policy inertia.

Here’s what to expect:

- Tight inventory will persist unless federal reforms adjust exclusions.

- Strong competition for smaller, downsized homes will continue.

- Potential price corrections could occur if exclusions are raised and more listings flood the market.

Policy experts argue that reforming the capital gains tax impact home sellers could release much-needed inventory — but timing matters.

If you’re planning to buy in 2026, stay flexible, monitor Santa Cruz housing market 2026 updates, and be ready to act fast when listings appear.

Your Game Plan: Navigating the Santa Cruz Market

Here’s how you can navigate it.

If You're Considering Selling:

- Talk to a Tax Pro, Not Just an Agent. Before you even think about listing, sit down with a tax advisor who understands real estate taxes in California. A simple conversation about the timing of your sale could save you tens of thousands of dollars, especially with the potential for 2026 capital gains tax rates to shift.

- Become a Record-Keeping Champion. Document every improvement. That kitchen renovation? The new roof? Meticulous records of every improvement you've made add to your home's "cost basis," which directly reduces your taxable gain. This is one of the most powerful ways to minimize capital gains tax liability on Santa Cruz property.

- Think Beyond the Traditional Sale. For some, a full sale might not make sense. It's worth exploring if a partial move, like building an ADU to downsize into, is a viable option for your property and lifestyle.

If You're a Buyer on the Hunt:

- Get Your Financials Locked and Loaded. In a market where sellers are wary of deals falling through, a solid pre-approval and a clean, straightforward offer are golden. You need to be the "easy" choice for a seller who's already facing a complex financial decision.

- Time your move strategically. Set up alerts and be ready to move quickly. If policy changes or market pressures convince more baby boomers to sell, new inventory could appear rapidly. Your opportunity might be a narrow window.

- Broaden Your Search Slightly. While everyone fights over the same few homes in central Santa Cruz, look to communities like Scotts Valley, Soquel, and Freedom. These areas might see supply loosen up first as they often represent a more attainable downsizing option for sellers.

FAQs

What is capital gains tax and how does it work? It’s a tax on the profit made when selling a home or other asset. For Santa Cruz homeowners, exclusions of $250,000 (single) or $500,000 (married) apply if you’ve lived there two of the last five years. Beyond that, the gain may be taxed federally and by the state.

What are the 2026 capital gains tax rates? Federal long-term rates range from 0% to 20%, depending on income. California adds up to 14.4% for top earners. Always check the IRS and California Franchise Tax Board for current brackets.

How does capital gains tax affect home sellers in Santa Cruz? With homes appreciating by over $1 million since the 1990s, most sellers now exceed the federal exclusion — creating large taxable gains and discouraging sales.

Can baby boomers avoid paying capital gains tax when selling their homes? Completely? Rarely. But there are strategies to how to avoid capital gains tax legally — like timing, increasing your cost basis through improvements, and ensuring eligibility for the exclusion.

How will the 2026 capital gains tax changes impact Santa Cruz buyers? If exclusions are expanded or indexed, more homes could enter the market — easing pressure on buyers but possibly altering pricing patterns.

How can sellers minimize capital gains tax liability on Santa Cruz property? Keep receipts for improvements, consult a CPA, and explore installment or 1031 exchange options (when eligible). See local specialists listed below.

Are there exemptions or exclusions for capital gains tax on primary residences? Yes. The $250,000/$500,000 exclusion remains the key benefit — though many experts argue it should be updated to reflect modern housing prices.

Bottom Line

The capital gains tax Santa Cruz situation isn’t just a fiscal issue — it’s reshaping who can move, who can buy, and how communities evolve.

Without reform, thousands of baby boomers real estate owners will remain “locked in,” leaving fewer opportunities for younger families and first-time buyers.

If you’re buying or selling in 2026, the key is to plan early, understand your tax exposure, and work with professionals who know both the numbers and the nuances of the Santa Cruz real estate 2026 landscape.

At David Lyng Real Estate, we help homeowners and buyers alike navigate these complexities — ensuring your next move, whenever it happens, is grounded in strategy and fact.

Paul Burrowes, CRS, CCEC, SFR, NHCP, LHC, REALTOR®

Paul Burrowes is a REALTOR® with more than fifteen years of experience and a long list of credentials, including CRS, CCEC, SFR, NHCP, and LHC. He promises to be prompt and forthright and serves as your personal adviser during the transaction, answering your questions and guiding you to the best possible choices. He is skilled at negotiating and strives for a win-win solution. Paul ensures that every little detail is taken care of so that the real estate transaction goes off without a hitch. Contact Paul Burrowes at paul@burrowes.com, (831) 295-5130, or DRE# 01955563; he proudly serves the counties of Santa Cruz, Monterey, Santa Clara, and Silicon Valley.

Local 1031 and tax deferment specialists

Carl F Worden III

Author, Educator, Tax Deferral Consultant

Tax Deferral Strategies LLC

www.DeferTax.com

www.StartAnExchange.com

3031 Tisch Way Suite 901

San Jose, CA. 95128

TF: 877-TAX-STRATEGY (877-829-7872)

PH: 408-261-2275

Ron Ricard

Account Executive, VP

IPX1031

ron.ricard@sis.ipx1031.com

(408) 483-1031

Work | (877) 747-7875

www.ipx1031.com/ricard

Thomas Foster, Esq., President

Nationwide 1031 Exchange Intermediary Services

331 Soquel Avenue, Suite 100

Santa Cruz, CA 95062

Office: 831-464-1031 (landline only)

Claire: 805-550-1410 (cell & text)

Tom: 408-499-4594 (cell & text)

tom@coast1031.com

CALIFORNIA STATE UPDATE

AB 130 (2025)

Summary: Establishes CEQA exemptions for infill housing projects that meet local zoning and are not located on sensitive environmental sites. This speeds up approvals and reduces legal barriers for urban development.

Streamlining CEQA means faster project delivery and more homes entering the market sooner. More inventory benefits buyers, sellers, and agents alike. It also provides certainty for builders considering infill projects, especially in constrained metro areas.

SB 131 (2025)

Summary: Companion to AB 130, this bill further expands CEQA streamlining and limits litigation delays for qualifying housing and infrastructure projects.

By reducing the risk of lawsuits that stall development, this measure keeps housing projects on schedule. Benefit from increased housing stock, particularly in high-demand areas where new construction often faces lengthy environmental review battles.

SB 484 (2025)

Summary: Creates a pilot program allowing 100% affordable infill housing in select coastal zones to bypass coastal development permit requirements.

While it helps produce affordable units in high-cost coastal areas, it may also limit private-market opportunities in those zones by favoring nonprofit developers. from increased affordability and workforce stability in these coastal communities.

SB 79 (2025) – Abundant & Affordable Homes Near Transit Act

Summary: Allows higher-density housing near major transit stops by overriding restrictive local zoning, promoting transit-oriented development (TOD).

More density near transit increases available housing in job-rich regions, potentially boosting sales and rentals. Infrastructure impacts may affect neighborhood desirability or parking availability.

AB 253 (2025)

Summary: Requires cities and counties to publicly post permit fees and timelines and allows third-party plan reviews if jurisdictions delay housing projects.

Improves transparency and predictability for builders and property owners, reducing costly permitting delays. Review project timelines and costs, encouraging investment and redevelopment in sluggish jurisdictions.

AB 413 (2025)

Summary: Directs HCD to translate key housing and grant program materials into multiple languages, ensuring broader community and developer participation.

Expands access to state housing programs among diverse populations, helping REALTORS® serve multilingual clients more effectively. May also open opportunities for developers and homeowners from non-English-speaking backgrounds to participate in housing incentive programs.

AB 507 (2025)

Summary: Expands “use-by-right” adaptive reuse, allowing vacant commercial or office buildings to be converted into housing in any zoning district without discretionary approval.

Creates new housing opportunities from empty retail and office spaces. Developers and investors with conversion projects, revitalize downtowns, and help communities repurpose underutilized properties into livable spaces.

AB 648 (2025)

Summary: Allows community colleges to develop student and staff housing on their own land without local zoning restrictions.

Addresses housing needs for education professionals and students, stabilizing local rental markets. Potential increased housing transactions in surrounding areas and new partnerships with educational institutions pursuing mixed-use housing models.

SB 131 (Budget Trailer Housing Package)

Summary: A broader state reform integrating CEQA streamlining, faster permitting, and reduced litigation into the state budget framework.

Encourages consistent implementation of housing acceleration policies across state agencies, cutting red tape and uncertainty that often delay projects and transactions. Benefits from increased housing supply and smoother development processes.

AB 130/SB 131 Package (June 2025)

Summary: Together, these bills form the cornerstone of California’s 2025 housing acceleration strategy—targeting environmental review reform, zoning streamlining, and litigation reduction.

By attacking multiple production barriers simultaneously, this package boosts long-term housing availability, expands the market for sales and rentals, and helps meet client needs in areas currently constrained by regulation.

FEDERAL UPDATE

Shutdown: A federal government shutdown

Can disrupt real estate transactions by delaying IRS tax transcript processing, FHA and VA loan endorsements, and USDA loan programs. Flood insurance renewals may also be affected. While Fannie Mae, Freddie Mac, and Ginnie Mae continue operations, backlogs.

Federal agencies create uncertainty and slowdowns. REALTORS® should prepare clients for possible delays in closings and financing.

Posted by Paul Burrowes on

Leave A Comment